Your Guide to Opening a Checking Account Online for Free

Have you ever tried to open a checking account online and been hit with confusing fees, unclear terms, or a clunky process? You’re not alone. With so many financial institutions out there: big banks, online-only platforms, and flashy apps, it’s easy to feel overwhelmed.

But here’s the good news: online banking doesn’t have to be confusing or costly. At Sound Credit Union, it’s fast, secure, and completely free. And because we’re a local credit union, you get the best of both worlds: advanced digital tools and personal support when you need it.

In this blog post, we’ll walk you through everything you need to know about opening a checking account online, from what online banking is to the benefits of digital banking and more. Whether you’re opening your first account or looking to make a switch, we’ll help you feel confident in your decision.

What is Online Banking (and Why It’s Worth Your Time)

Online banking lets you manage your money from anywhere, whether you’re at home, on the go, or out grabbing coffee. With secure websites and user-friendly mobile apps, you have full control of your accounts 24/7.

With a reliable online banking platform, you can:

- View your balances and transaction history

- Transfer money between accounts

- Pay bills or set up recurring payments

- Deposit checks with your phone using our mobile app

- Instantly send money to anyone with our “Pay Anyone” feature

- Monitor your spending goals and budgets in one convenient dashboard

If you’re wondering how credit union online banking compares, many credit unions offer the same digital tools as larger banks, with added perks like lower fees, more personalized service, and community-driven values.

At Sound, our online banking platform is designed with real people in mind. That means easy navigation, secure features, and support from local experts when you need it. Unlike some online banking apps that offer limited services or automated-only help, we’re proud to offer full-service online banking with a personal touch.

Why Open a Checking Account Online?

A checking account is often the foundation of your financial life. It’s where your paycheck goes, where you pay your bills, and how you handle daily transactions. Today, opening a checking account online comes with several major perks:

- Convenience: No appointments, no waiting. Open your account anytime, from your couch, on your lunch break, or even in your pajamas.

- Speed: Most applications take just minutes to complete.

- Access: With online banking, your account is always just a few clicks away, whether you’re at home or halfway across the country.

- Cost: Many online checking accounts skip the monthly maintenance fees, and at Sound, ours is truly free. No hidden costs, just straightforward service.

Opening a checking account online makes it easy to manage your money without branch visits or hidden fees. At Sound Credit Union, you get powerful tools and the support of a local credit union, all in one.

How to Open a Checking Account Online For Free

Not sure where to start? Here is a simple breakdown of how to open a checking account online:

-

- Compare Account Options: Not all checking accounts are created equal. Look for an account that fits your lifestyle and needs. Consider:

- No monthly fees

- Minimum balance requirements

- Mobile features like remote check deposit and bill pay

- Online banking tools with account alerts, budgeting, and more

- Access to real, local support

- Gather What You Need: To apply for an online checking account, you’ll typically need:

- A government-issued ID (like a driver’s license or passport)

- Your Social Security number or ITIN

- A valid U.S. address

- An email address and your phone number

- Submit Your Application: Visit the provider’s website and follow the steps to open a banking account online. The process usually includes identity verification, selecting account features, and agreeing to the terms.

- Fund Your Account: You may be asked to make an initial deposit. This can often be done through a transfer from another account, a debit card, or a mobile check deposit using an online banking app.

- Set Up Digital Access: Once your account is open, you’ll want to set up your online banking login, download the mobile app, turn on account alerts, and link external accounts if needed.

- Compare Account Options: Not all checking accounts are created equal. Look for an account that fits your lifestyle and needs. Consider:

Feeling stuck? Our local team is here to support you by phone, online, or in person at your nearest branch.

What To Watch Out For

Here are a few things to look out for when choosing an online banking provider:

- Fees & Fine Print: Some accounts may advertise “free” but sneak in fees for things like paper statements or ATM usage. Always read the details.

- Security: Use strong passwords and enable two-factor authentication. With Sound, you also get fingerprint login, secure messaging, and customizable alerts.

- Mobile App Access: Make sure your provider offers a reliable, well-reviewed online banking app.

- Customer Support: Some platforms only offer automated help. At Sound, you can always talk to a real person.

Even the best platforms can experience occasional online banking issues, such as temporary outages or app bugs. Having access to real, responsive support can make all the difference.

Common Online Banking Issues (and How to Avoid Them)

Even the best online banking apps and services can hit a few snags. Here are some common online banking issues and what to do:

- Login problems: Make sure your username and password are correct and that your app is updated.

- Mobile deposit delays: Check your institution’s funds availability policy to avoid surprises.

- Connection errors: Using a secure, strong internet connection can help prevent glitches. Check your internet connection and try connecting from another location.

- App updates: Always run the latest version of your banking online app for security and performance.

Most of these issues can be solved in minutes. Our support team is always here if you need backup.

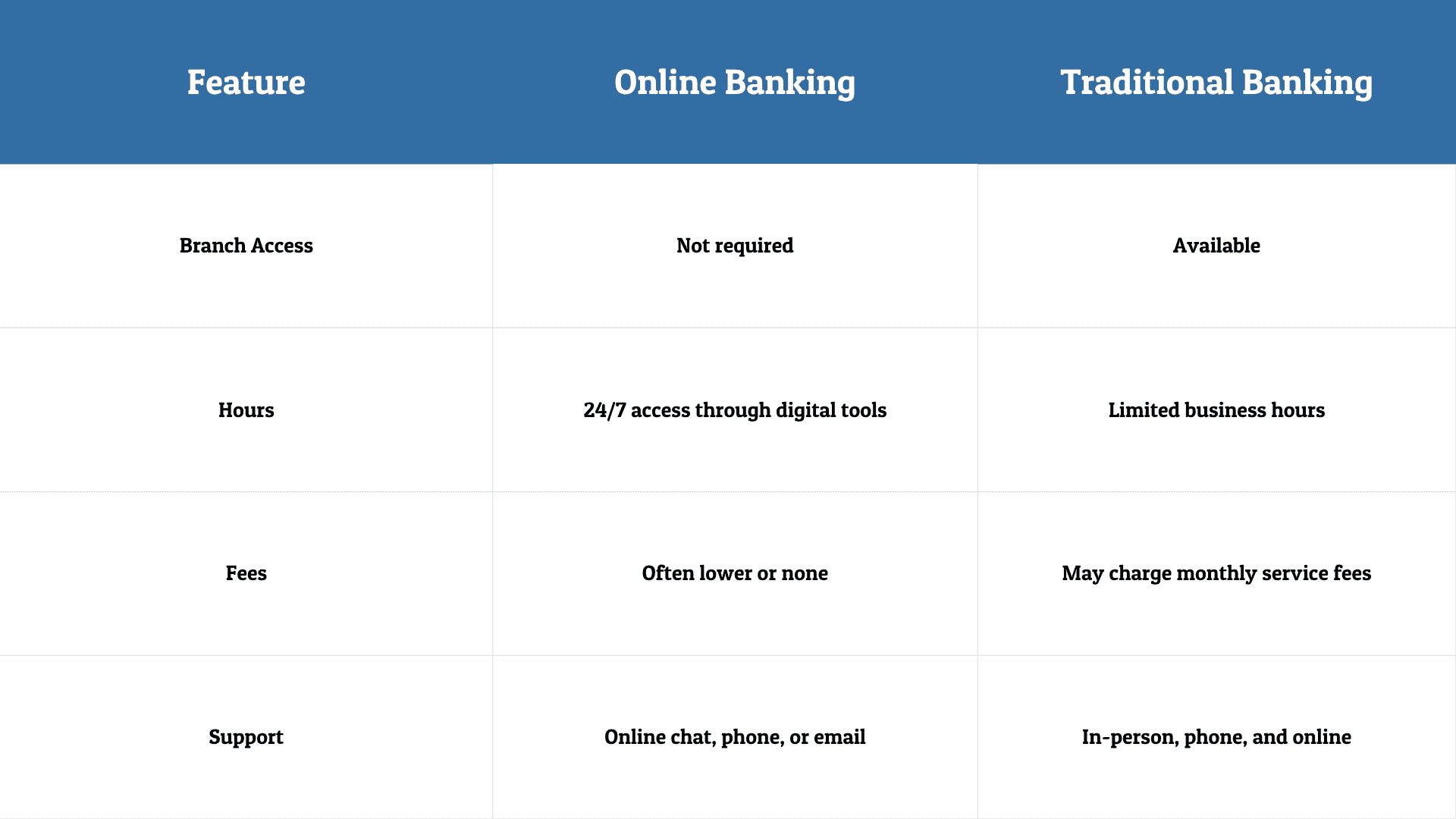

Online Banking vs Traditional Banking

Both online and traditional banking have their place, but they offer different experiences. Here’s a quick comparison:

If you’re looking for flexibility, convenience, and fewer fees, online banking is a smart choice. Prefer in-person service? That’s important too. With Sound Credit Union, you don’t have to choose, you get the power of digital banking backed by the personal support of your local branch.

Is Online Checking Right For You?

If you’re looking for a safe, flexible, and often fee-free way to manage your money, it might be time to open a checking account online. You’ll get the tools you need to stay organized, stay informed, and stay in control—no matter where life takes you.

Just remember to compare your options, read the details, and choose a provider that offers the right mix of technology and support for your needs.

And if you’re ever unsure, Sound Credit Union is here to help answer your questions and guide you through the process. Whether you’re opening your first account or just looking for something more convenient, we believe banking should be clear, easy, and centered around you.