Retirement Simplified

Powered by Silvur

Retire with Confidence

Plan Smarter. Retire Stronger.

We’ve partnered with Retirement Simplified, powered by Silvur, to bring you expert guidance and easy-to-use tools designed to strengthen, validate, and improve your retirement plan.

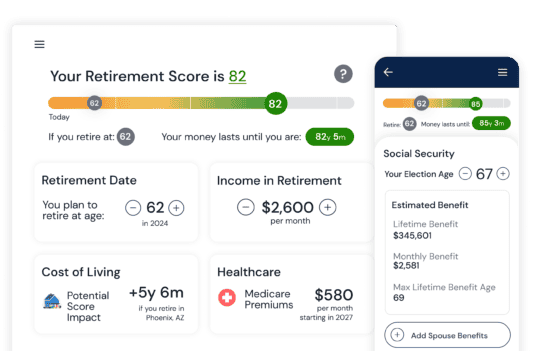

Calculate your personal retirement score

Calculate how long your money will last in retirement—down to the year and month. Our Social Security, Medicare, and cost of living tools let you run different scenarios to see how your choices impact your plans based on where you live, when you retire, and more.

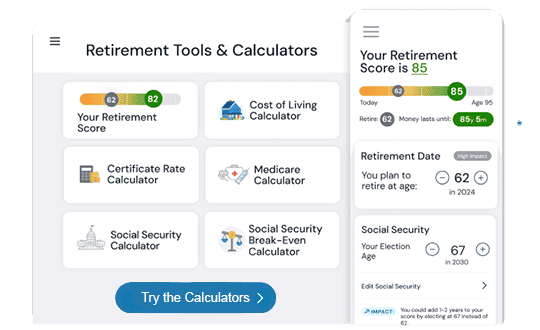

Easy-to-use tools & calculators

Adjust your inputs and make informed decisions on important retirement questions, like:

- When should I elect Social Security

- How long will my savings last?

- What will Medicare cost me?

- Where should I retire?

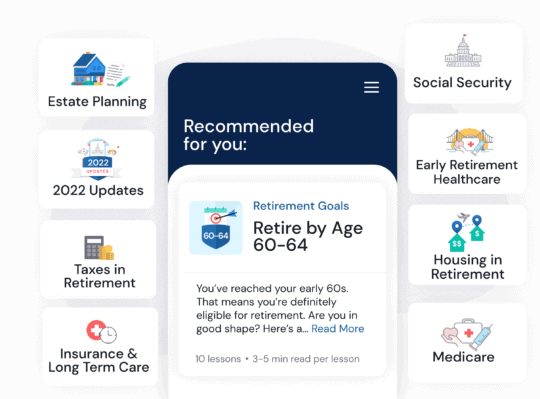

Best-in-class education

Learn just what you need to know—right when you need to know it—with concise and easy-to-understand courses from our experts on Social Security, Medicare, taxes, and other key retirement topics.

Take the guesswork out of retirement.

Activate your free Retirement Score profile today!

Want to be money smart? We’ve got your back.

Visit our Life & Finances section for tips, tutorials and everyday advice to help you slay your personal finances.

How Much Should You Save For Retirement?

What do you want your retirement to look like? If you haven’t asked that question, it’s time. Continue reading

Five Good Money Habits to Boost Your Retirement Savings

Understanding the give-and-take of budgeting is a powerful skill, and it’s easier to cut spending when you can put it in the context of achieving a goal. Continue reading

How Much Should I Save vs. Invest? Understanding the Difference Between Saving and Investing

Discover the difference between saving and investing and learn how to balance both, build an emergency fund, and start investing with confidence. Continue reading