Your Guide to Business Loans: How to Finance Growth with Confidence

Growing a business takes vision, determination, and resources. But even the best ideas need financial support to truly take off. That’s where business loans play a vital role. From launching a startup to smoothing out everyday expenses or funding a major expansion, the right financing can give you the stability and confidence to move forward with your plans.

At Sound Credit Union, we understand that loans of any kind can quickly become overwhelming and unnecessarily complicated. In this guide, we’ll break down everything you need to know about business loans: how they work, the different types available, and how to find the option that best fits your goals.

What are Business Loans?

At their core, business loans are borrowed funds you repay over time with interest. Businesses use them for all kinds of needs, from buying equipment, hiring staff, expanding into a new location, or simply keeping operations running smoothly.

Think of a business loan as a financial tool: it gives you the capital you need today, so you can build for tomorrow.

How do Business Loans Work?

The process of getting a loan may feel intimidating at first, but it’s often easier than many business owners expect. Here’s a closer look at how it works from start to finish:

- Business Loan Application: This is where you provide the basics about your business. Lenders typically ask for:

- Business financial statements (like income statements or balance sheets)

- Tax returns (personal and/or business)

- Details about your business plan and how you’ll use the loan

- Your credit history

- Tip: Having these documents organized ahead of time is a great way to set yourself up for success!

- Approval: Once your application is submitted, the lender reviews it to determine if you qualify. They’ll look at factors such as:

- Credit Score: A strong score can help you secure better interest rates and terms.

- Collateral: Some loans require assets (like property or equipment) as security.

- Business Revenue & Cash Flow: Lenders want to see that you can comfortably repay the loan.

- Tip: As approval times do vary, make sure to plan ahead. Some fast business loans can be approved within days, while other more complex loans may take weeks.

- Funding: If approved, you’ll receive the loan! Depending on the type, this could be:

- A lump sum payment: This is perfect for large, one-time expenses like buying equipment.

- A revolving business line of credit: This lets you borrow what you need, repay it, and borrow again.

- Repayment: Finally, you’ll repay the loan over an agreed-upon schedule. This includes both the principal and interest. Repayment terms can be:

- Short-term business loans (often less than 18 months): Designed for quick payback. These are best for immediate needs that you plan to pay off quickly, such as seasonal inventory, payroll gaps, or unexpected repairs. These loans usually have higher interest rates than long-term options, but the quick access to cash and shorter repayment period make them ideal for bridging temporary cash flow issues.

- Long-term business loans (3+ years): Structured for larger, long-term investments like commercial real estate, major equipment purchases, or business expansion. Repayment terms often stretch over several years, with lower monthly payments that spread the cost out over time. Long-term loans are often backed by collateral and require stronger financial documentation.

- Tip: Staying consistent with repayment not only keeps you in good standing but also helps you build business credit for the future.

At Sound Credit Union, we simplify this entire process. Our business banking team is available to help you through every step, answer your questions, and help match you with the right credit union business loan so you can borrow with confidence.

Types of Business Loans

Not all loans look the same. Here are the most common types of business loans and what they’re best for:

- Commercial Real Estate Loans: These loans help businesses purchase, refinance, or renovate property. Whether you’re buying your first building, expanding to a new location, or updating your existing space, a commercial real estate loan spreads the cost over time and builds equity in your property.

- Commercial Vehicle Loans: If your business relies on vehicles, whether delivery vans, service trucks, or specialty equipment, commercial vehicle loans make it possible to buy or lease without draining cash reserves. Terms are structured to match the lifespan of the vehicle, keeping payments predictable.

- Business Term Loans: A traditional option for financing larger investments, term loans provide a lump sum you repay over a fixed period. They’re ideal for long-term projects like equipment purchases, facility upgrades, or funding major growth initiatives.

- Business Line of Credit: Unlike a lump-sum loan, a line of credit gives you ongoing access to funds you can draw on as needed. It’s a flexible solution for managing working capital, covering seasonal slowdowns, or handling unexpected expenses. You only pay interest on the funds you use, making it a practical safety net.

- SBA Loans: Backed by the U.S. Small Business Administration, SBA loans are designed to make financing more accessible for small businesses. They often come with competitive rates, longer repayment terms, and lower down payment requirements. SBA loans can be used for a wide variety of purposes, including startup costs, equipment, real estate, and working capital.

- According to the U.S. Small Business Administration (SBA), small businesses received over $27.5 billion in SBA 7(a) loans in 2023, making it the most widely used loan program for business growth.

Choosing the Best Business Loans for Your Needs

With so many options available, the “best” loan isn’t necessarily the one with the lowest rate, it’s the one that fits your business’s unique goals and circumstances. Here are some key questions to guide your decision:

How Much Do I Need?

Start with a clear budget for your project or expense. The size of your funding needs often determines the right loan type:

- Expanding to a new office or purchasing property → Commercial Real Estate Loan

- Buying new equipment or technology → Business Term Loan

- Covering seasonal expenses or managing payroll → Business Line of Credit

- Purchasing delivery vans or service vehicles → Commercial Vehicle Loan

- Launching or scaling a small business with government-backed support → SBA Loan

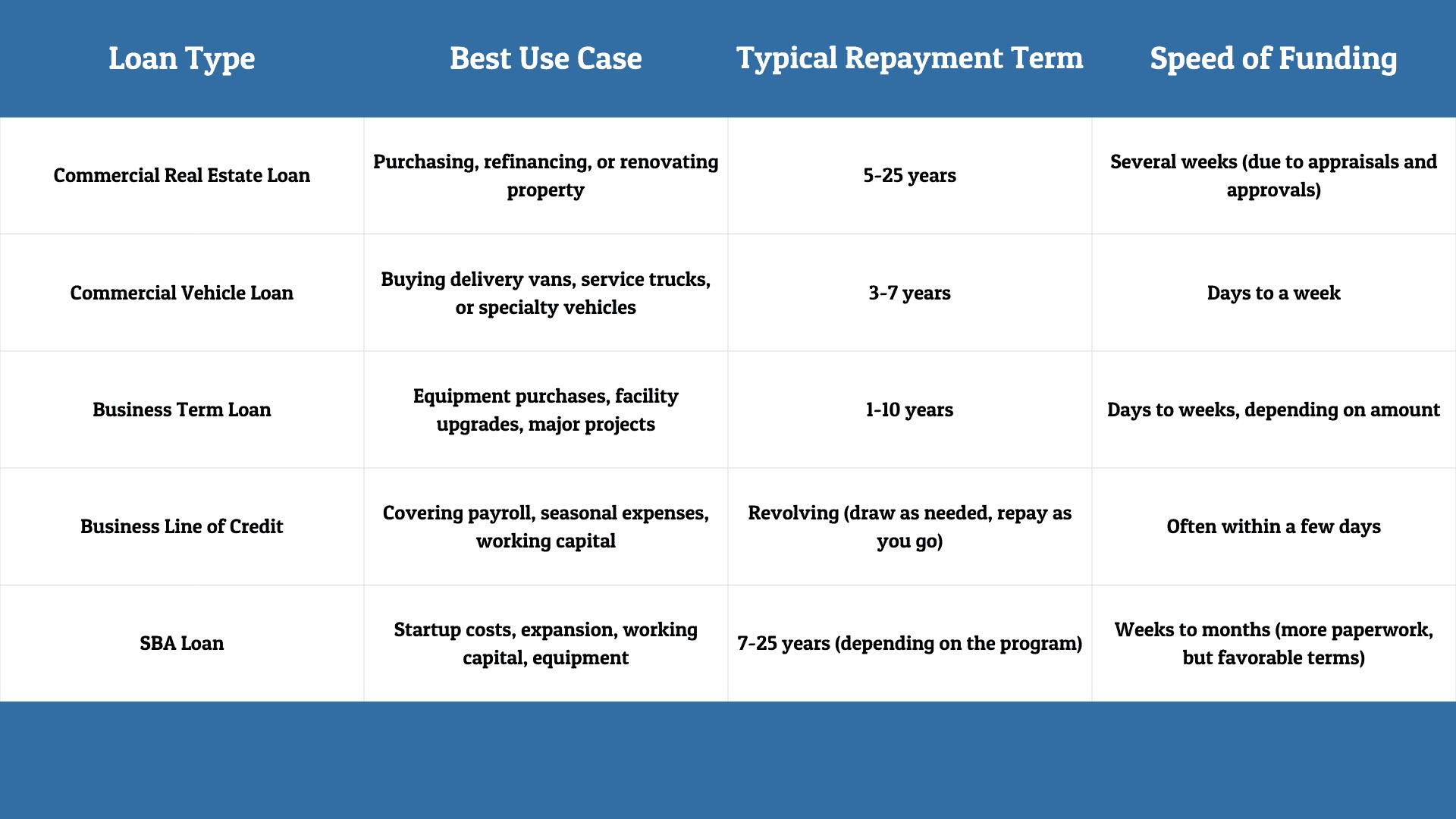

Here is a graphic for further understanding:

What Repayment Terms Make Sense?

Shorter repayment schedules mean you’ll pay off your loan faster and likely save on interest, but they require higher monthly payments. Longer terms reduce the strain on cash flow by lowering payments, though you’ll pay more interest over time. A good rule of thumb: match your loan term to the lifespan of what you’re financing (for example, a commercial vehicle loan might have a shorter term than a real estate loan).

What Interest Rates are Available?

Interest rates vary widely depending on the type of loan, the lender, and your financial profile. Online lenders sometimes offer speed but at higher rates, while traditional banks may have stricter requirements. Credit unions often strike the best balance, with loans that feature competitive business rates, fewer fees, and terms designed to support local businesses.

Who Do I Want to Work With?

The relationship with your lender matters. You’re not just signing paperwork, you’re entering into a financial partnership. A responsive lender who understands your business and your community can provide guidance, flexibility, and support beyond just the loan itself.

As credit unions are member-owned, they’re more focused on serving people, not shareholders. That often means lower costs, more flexibility, and personalized support compared to large national banks. With a credit union business loan, you’re not just getting financing, you’re gaining a partner who’s invested in your long-term success.

- According to a 2024 Credit Suite Report on Small Business Lending, businesses had the most luck with being fully approved at credit unions, with a 51% full approval rate.

The 5 Benefits of Business Loans

When used strategically, business loans are more than just a way to pay the bills. They’re also a tool that can strengthen your business and set you up for long-term success. Here are five main benefits of business loans:

- Build Your Business Credit Profile: Just like personal credit, your business credit score matters. By borrowing responsibly and making on-time payments, you establish a track record that makes it easier to qualify for larger loans, better rates, and more favorable terms in the future. A strong credit profile also signals reliability to vendors and partners.

- Example: A local retailer that starts with a small business term loan and repays it on schedule may later qualify for an SBA loan to expand into multiple locations.

- Smooth Out Cash Flow During Slower Seasons: Every business faces ups and downs: seasonal dips, delayed invoices, or unexpected expenses. A loan can help bridge those gaps so you can continue paying employees, ordering inventory, and keeping operations running without stress. Business lines of credit are especially helpful here, since you can draw only what you need, when you need it.

- Example: A landscaping company might use a business line of credit during the winter months when work slows, ensuring steady payroll and equipment maintenance until peak season returns.

- Provide Capital for Expansion and New Opportunities: Growth often requires upfront investment. Whether you’re opening a second location, adding new equipment, or hiring staff to take on more clients, loans give you access to the capital needed to seize opportunities when they arise. Without financing, many businesses miss out on chances to grow at the right time.

- Example: A manufacturing business could use a business term loan to purchase new machinery that doubles production capacity and increases revenue potential.

- Offer a Financial Cushion for Unexpected Expenses: From equipment breakdowns to emergency repairs, unplanned costs are part of running a business. Having access to financing, through a business term loan or line of credit, means you’re prepared to handle surprises without derailing your cash flow.

- Example: A restaurant might rely on a fast business loan to replace a walk-in refrigerator that suddenly fails, keeping operations running and customers happy.

- Strengthen Business Stability: A smart loan isn’t just about solving today’s challenges, it’s about positioning your business for tomorrow. With the right financing, you can invest in infrastructure, staff, or systems that improve efficiency, increase profitability, and enhance your competitive edge over time.

In short, a well-chosen loan is more than borrowed money. It’s a financial strategy that supports stability, growth, and resilience.

Explore Your Business Loans With Sound Credit Union

Financing your business doesn’t have to feel overwhelming. At Sound Credit Union, we make it simple to find the right loan for your needs, whether you’re looking for startup funding, a flexible line of credit, or a long-term financing solution.

Contact Sound Credit Union today to learn more about our credit union business loan options and see how we can help you finance your growth with confidence.

Cory Deter

Cory Deter serves as the Vice President of Business Lending at Sound Credit Union, bringing 20 years of experience in business lending to his role. He holds a Master’s in Business Administration and is a graduate of the Pacific Coast Banking School. In this position, Cory oversees the Business Lending Department, playing a pivotal role in managing business loan production and commercial credit risk, which ensures the success of the credit union’s lending initiatives. He is dedicated to developing and mentoring his team to achieve excellence in service delivery and is passionate about fostering relationships with business members, helping them navigate their financial needs.