Top 5 Benefits of Choosing a Short Term CD for Your Savings

Saving money shouldn’t come at the cost of flexibility. A short term certificate of deposit (CD) gives you the best of both worlds: stable guaranteed returns and flexible access to your funds. Whether you’re saving for a down payment, a vacation, or simply want your emergency fund to earn more interest, a short term CD can be a smart and secure way to grow your savings.

At Sound Credit Union, we make it easy to find the best short term CD rates that fit your goals. In this guide, we’ll explain what a short term CD is, how it works, and the top five benefits of choosing one as part of your savings strategy.

What Is a Short Term CD?

Before diving into the benefits, let’s define what a short term CD actually means.

A short term CD, or short term certificate of deposit, is a savings product that lets you earn a fixed interest rate over a set period of time, usually between three and twelve months. You deposit a specific amount, leave it untouched until the CD matures, and earn guaranteed interest in return.

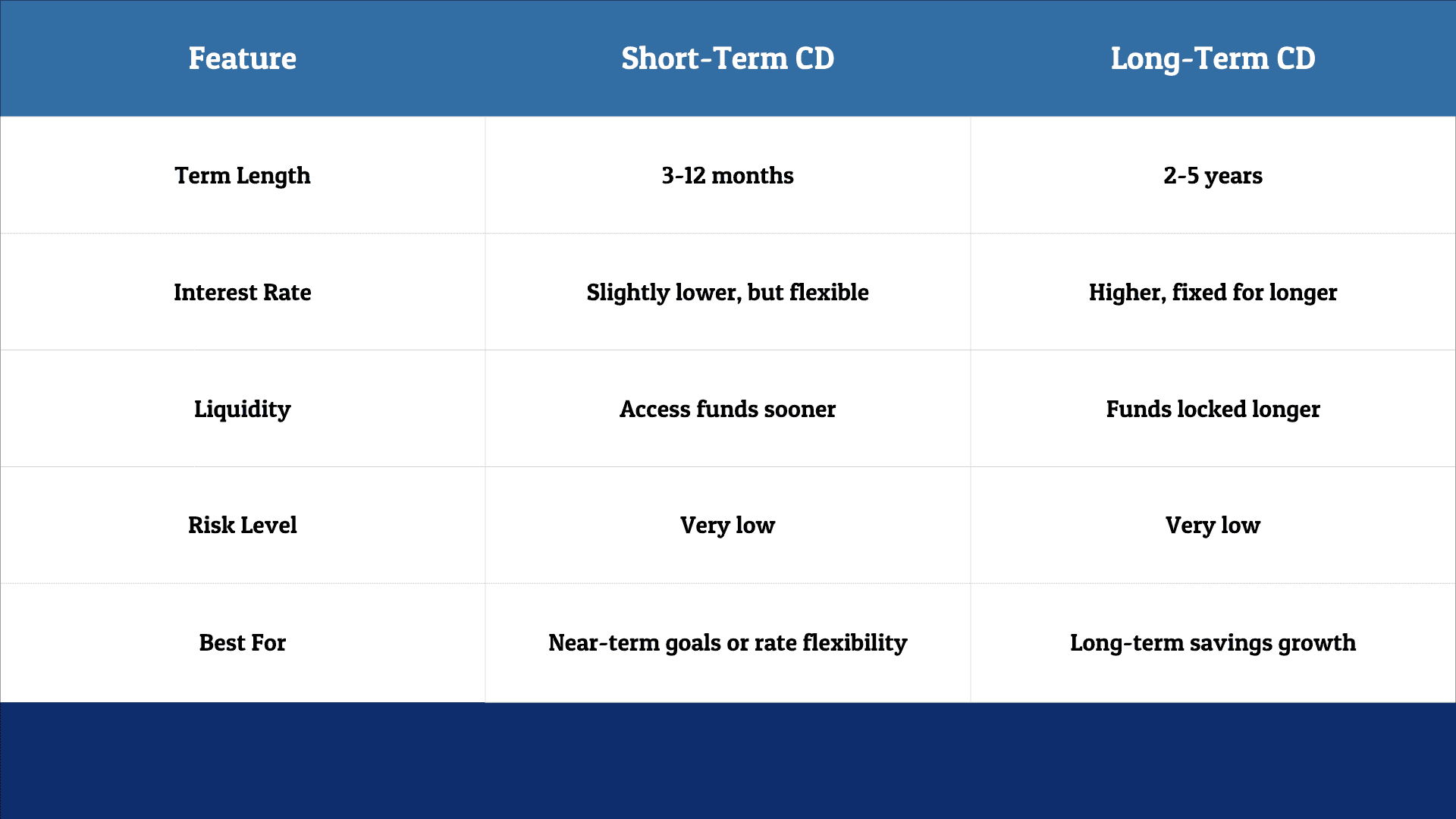

Unlike long-term CDs, which can tie up your funds for several years, short term CDs provide quicker access to your money while still earning more than a traditional savings account. You might be asking, “Are short term CDs worth it?” The answer depends on your financial goals.

For many savers, the shorter term delivers a winning combination of flexibility, security, and steady growth, making it a smart choice for near-term goals. Let’s dig into the top five benefits of short term certificates of deposit below.

1. Access Your Savings Sooner

One of the biggest advantages of a short term CD is liquidity. Because the term is shorter, you’ll have access to your funds sooner, often in just a few months. This means you can reach your savings goals sooner while still earning more interest than a traditional savings account.

This makes short term CDs a great fit for savers who:

- Have upcoming expenses like a vacation or a car purchase.

- Are building an emergency fund and want higher returns than a standard savings account.

- Prefer to test out CD investing before committing to longer terms.

Ultimately, short term CDs give you the structure to stay disciplined with your savings while maintaining peace of mind.

2. Take Advantage of Competitive Short Term CD Rates

When interest rates are changing, flexibility matters. A short term CD allows you to take advantage of today’s best short term CD rates, and when your term ends, reinvest at a potentially higher rate.

This flexibility helps your savings stay responsive to the market. By opening a high-yield short term CD now, you can lock in a competitive rate and start earning steady, guaranteed returns, without tying up your funds for years. When your CD matures, you’ll have the freedom to reassess the market, compare short vs. long-term CD rates, and choose the option that best supports your financial goals.

At Sound Credit Union, our members benefit directly from our not-for-profit structure. Because we return earnings to members instead of shareholders, we’re able to offer some of the best short term CD rates available, helping your savings grow faster and work harder for you.

Ready to take the next step? Open a certificate account with Sound Credit Union and watch your savings grow securely and steadily.

3. Enjoy Low Risk and Predictable Returns

If you’re looking for a safe, predictable way to grow your money, a short term CD is one of the most dependable savings options available. It offers consistent returns without the uncertainty that often comes with market-based investments.

Here’s why it stands out:

- Guaranteed earnings: Your rate and total return are locked in from the start, no surprises or fluctuations.

- Federally insured: Deposits at Sound Credit Union are NCUA-insured up to $250,000 per member, per institution, so your money is fully protected.

- No market volatility: Unlike stocks or mutual funds, your CD balance isn’t affected by market changes.

This combination of security and predictability makes short term CDs an excellent choice for conservative savers, retirees, or anyone who prefers stability over speculation.

4. Keep Your Savings Strategy Stable with CD Laddering

A CD ladder is a simple but effective strategy that helps you balance access to your money with the opportunity to earn steady returns. It works by opening multiple CDs with staggered maturity dates, so you can take advantage of changing rates while keeping part of your savings available at regular intervals.

How CD Laddering Works

- Divide your savings into several CDs with staggered terms.

- For example, 3, 6, 9, and 12 months.

- As each CD matures, reinvest it into a new short term CD.

- Over time, this creates a rotation where one CD matures every few months, giving you both consistent earnings and ongoing flexibility.

This approach helps you make the most of short vs. long-term CD rates while reducing the risk of locking your money in at a lower rate for too long. CD laddering keeps your savings plan adaptive, strategic, and continuously growing, all without sacrificing access when you need it.

Have questions? Contact Sound Credit Union today to learn how CD laddering can fit into your savings strategy.

5. Predict Your Return Easily With a CD Calculator

Before opening a CD, it’s helpful to understand exactly how much your money could grow. A certificate calculator makes this simple by showing your estimated earnings based on your deposit amount, term length, and interest rate.

For example:

- If you deposit $10,000 into a 6-month CD at 5.00% APY, you’ll earn about $250 in guaranteed interest by maturity, with no market uncertainty or risk.

A CD calculator is a simple, transparent way to compare options and choose the best short term CD for your savings goals. It also helps you visualize how reinvesting, or laddering, your CDs over time can steadily boost your total returns.

Ready to see what your savings could earn? Use Sound Credit Union’s certificate calculator today to estimate your returns and find the right short term CD for you.

Short-Term vs. Long-Term CD Rates: Which is Right For You?

In short, short term CDs are ideal if you want to stay flexible, adjust to rising interest rates, or maintain easy access to your money. Long-term CDs work better when you’re comfortable locking in funds for a higher rate over several years.

Ready to Find the Best Short Term CD for You?

At Sound Credit Union, we make saving simple and rewarding. Our short term CDs offer competitive rates, flexible terms, and peace of mind knowing your money is secure and growing.

Whether you’re comparing short term CD rates, planning a high-yield short-term CD, or just getting started with savings, our team is here to help you find the right fit.

Contact us today or use our CD calculator to see how quickly your savings can grow with the safety, stability, and confidence you deserve.